Investment Overview

Investments

An important objective that guides the investment of the TTU System long-term endowment is to preserve and maintain the real purchasing power of the fund’s principal. With this objective in mind, the TTU System long-term endowment places permanent, or endowed, funds in its Long-Term Investment Fund where they are collectively invested in a professionally managed, diversified portfolio including:

Financial and Investment Objectives

Financial and Investment Objectives

To meet the overall goal of generating enduring value for participating funds, the TTU System has the following primary objectives for its Long-term Investment Fund.

- • The Strategic objective is to preserve the “real” value (purchasing power) of the principal (the gift value) and provide for spending distributions, while providing a stable source of funding for scholarships, academic chairs and other donor discretion initiatives.

- • The Performance objective is to meet the return of the passive global 60/40 Policy Benchmark plus 1.00% over rolling three-year periods.

Evaluation of progress toward these objectives requires the following:

- • A long-term perspective that implies a high average allocation to equity securities and consequent market price volatility.

- • Recognition that the desire to maintain the purchasing power of the principal and to produce a stable and predictable spending stream involves trade-offs that must be balanced in establishing the investment and spending policies.

Target Asset Allocation

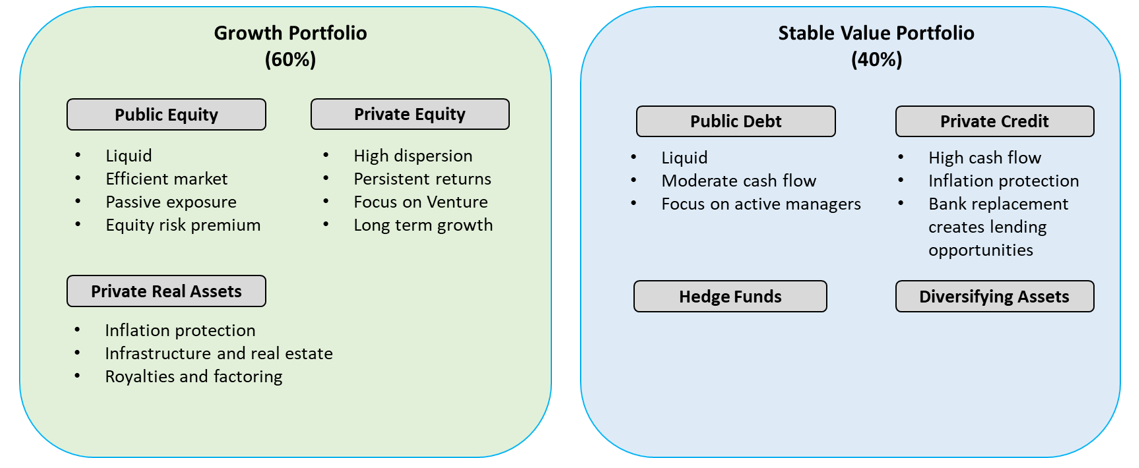

Policy asset allocation targets are the foundation of the investment process, as no other aspect of portfolio management plays as great a role in determining a fund’s ultimate performance. The TTU System’s asset classes are defined by differences in their expected response to economic conditions, such as price inflation or changes in interest rates, and are weighted in the endowment portfolio by considering risk adjusted returns and correlations. The Long Term Investment Fund (LTIF) combines the asset classes in such a way as to provide the highest expected return for a given level of risk.

Management

The Office of Investments is responsible for managing the Long Term Investment Fund. The TTU System strives to earn the highest possible return from interest, dividends, realized gains and market value increases while maintaining an appropriate level of risk versus the Policy Benchmark. To do this, the services of external investment managers are utilized. Both the Office of Investments and the IRC closely monitor the performance of the endowment portfolio with re-allocations occurring as needed.

The Chief Investment Officer manages a team of investment professionals who develop the strategic direction of the portfolio, tactically allocate to attractive opportunities, and select investment managers all within a risk management framework.

Investment Resource Council (IRC)

The IRC is a resource council that supports stewardship and communication. The IRC is managed by the Vice Chancellor and CFO, in coordination with the Chief Investment Officer.

Consulting

NEPC, LLC provides investment consulting services including asset mix and spending reviews, investment guideline reviews, investment manager searches, and performance evaluation.

Spending Policy

A goal of the TTU System's Long Term Investment Fund is to achieve investment performance that supports stable and predictable endowment spending from year-to-year in order to provide funding for programs across the campuses.

The Spending Policy determines the amount that may be spent annually from each participating fund to support its intended purpose.

The TTU System long-term endowment’s Spending Policy, as set by the Board of Regents in the Long-Term Investment Fund policy, is set at 4.5% of average market value of the previous 12 quarters

Generous donor support, coupled with investment returns, resulted in the growth of endowment distributions over the past decade. The impact on students, faculty and university programs has been substantial and touching nearly every part of campus.

Built-In Growth

If annual endowment earnings exceed annual distribution, the excess is retained in the endowment pool. This increases the fund’s market value, increasing the base that the distribution is based upon which, in turn, enhances future distributions for each individual endowment account and helps compensate for inflation. Therefore, an individual endowment fund’s principal and number of shares do not increase, but the market value will increase with excess returns. While there is no guarantee this method will keep the fund ahead of inflation, the strategy is intended to help preserve the purchasing power of the endowment and, thereby, ensures that the purposes for which any named fund was established are carried out indefinitely.